Tax Preparation

At Premier Tax Service, our team of experienced tax specialists includes only the most skilled and professional Austin & San Antonio tax preparers.

Save yourself money

Once a year, tax time arrives, and it’s at this time that we all must prepare and file our taxes. Although many choose to go at this alone each year, the truth is unless you are proficient with tax laws, you could be costing yourself much more in the end.

Why Hire A Tax professional?

Using professional tax preparation in San Antonio to prepare your returns ensures that you are filling out your returns properly and won’t be penalized for mistakes. And yes, the IRS will fine you for any mistakes on your tax returns. Hiring a professional tax preparer also ensures you are paying the least amount in taxes and are being refunded all the money you are legally allowed.

ensure you pay the least amount possible

Ensure you’re being refunded your money

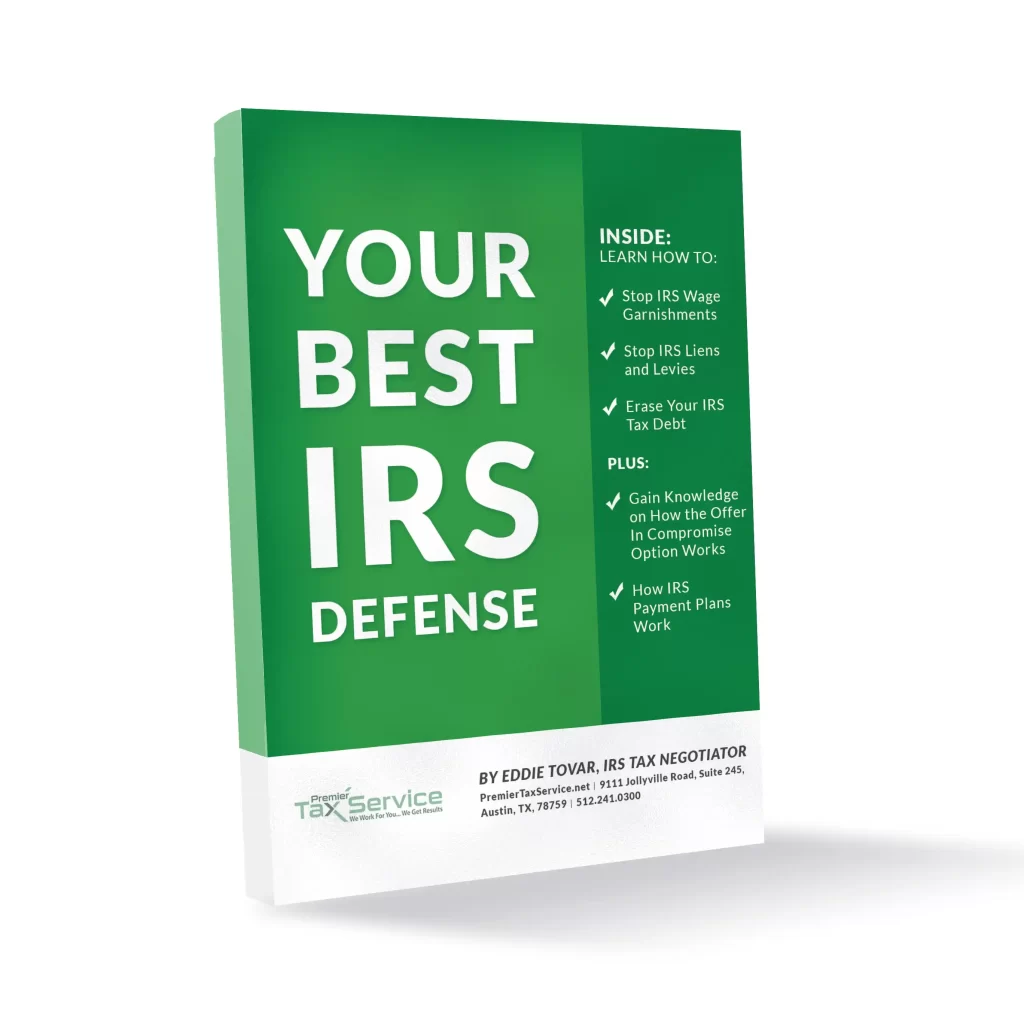

Learn more about Premier Tax Service and how we can help you with this free e-book, Your Best IRS Defense, by Premier Tax Service expert negotiator, Eddie Tovar!

use a trustworthy company

When choosing a tax preparer, it’s important to make sure you are going with a reputable company. Though many claim they can do your tax returns for you, even if you have someone prepare your return, you are still legally responsible for what’s on it, so be sure to utilize tax preparation services from a trustworthy company or individual. Not doing so can unfortunately lead to some very severe repercussions, including penalties and, in some cases, jail time.

At Premier Tax Service, our team of experienced tax specialists includes only the most skilled and professional tax preparers. We prepare hundreds of tax returns every year and have the experience to help you save time and money.